Gift Aid

Did you know that your donation could be worth 25% more through Gift Aid?

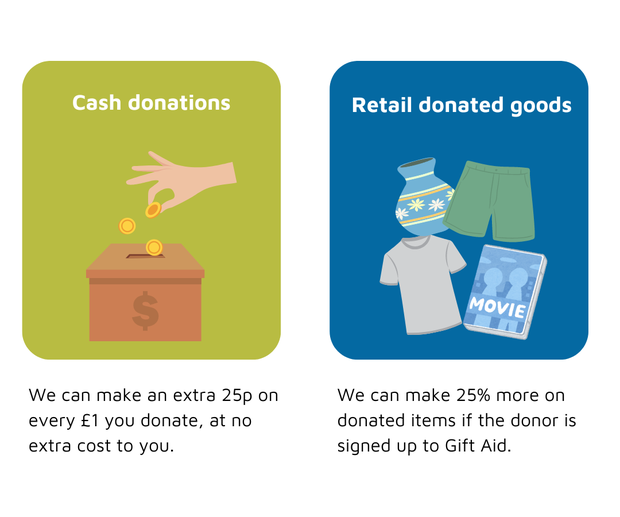

There are two types of Gift Aid that can help NAWT

What is Gift Aid?

Gift Aid is a process that we use to claim a refund of the tax already paid by the donor. This 25% extra revenue can be claimed from the government when a person donates cash, or items to charity, and agrees to Gift Aid. It is at no extra cost to the donor or the charity, it's just a refund on tax they have already paid and is paid directly to us.

How do I sign up to Gift Aid?

Are you a UK tax payer paying either Income or Capital Gains Tax? Please note, that self-assessment taxpayers can also qualify for Gift Aid. Just make sure to keep a record of your donations as you will need to report these on your tax return. HMRC can then adjust your tax code.

If so, you can sign up today simply by downloading the form below, and sending it back to us at the following address:

National Animal Welfare Trust, Tyler's Way, Watford-By-Pass, Watford, WD25 8WT

Or, please email it to fundraising@nawt.org.uk

Can I apply Gift Aid to past donations?

The answer is, yes. We can apply Gift Aid to all monetary donations made in the last 4 years.

What if I change my mind?

Please do let us know if your circumstances change, by calling us on 020 8950 0177 (option 1) or emailing fundraising@nawt.org.uk.

Retail Gift Aid

Four of our five charity shops can currently claim Gift Aid on your donated items (Woburn Sands will be able to offer this service at some point in 2025). You can sign up in one of two ways:

- Sign up via our online portal

- When in store, please speak to a member of staff who will be able to assist you

Please note, we are required to tell you how much your items have raised each tax year once your sales have reached £20 or every 3 years - whichever comes first.